If we’ve been doing our job as your fiduciary advisor, you might already be able to guess what our take is on current market news: Unless your personal goals have changed, stay the course according to your personal plan. Have you checked your plan progress in the last couple of days? If not, you should.

Still it never hurts to repeat this steadfast advice during periodic market downturns. We understand that thinking about scary markets isn’t the same as experiencing them. No matter what happens next, context is always helpful to better understand what is happening around you. This article today by Neil Irwin in the New York Times does a great job of giving context.

Good news is bad news?

So, what’s going on? Why did U.S. stock prices suddenly drop after such a long, lazy lull, with no obvious calamity to have set off the alarms? As Financial Planning guest columnist Kimberly Foss, CFP® described: “To understand the anxiety that led to many investors rushing to sell last week, you need to follow some tortuous logic. … If American workers are getting paid more, then companies will start charging more for whatever they produce or do, which might boost inflation. ‘Might’ is the operative word.”

“Good news, it seems, is bad news again,” this Wall Street Journal columnist added.

Context and Action

While these sentiments may suggest the catalyst for the current drop, they do not inform us of what will happen next. Sometimes, market setbacks are over and forgotten in days. Other times, they more sorely test our resolve with their length and severity. As Jason Zweig of The Wall Street Journal pointed out yesterday, ‘The stock market didn’t get tested – You did.’ You must understand that the four most expensive words in finance are, ‘This time it’s different.’ We can’t yet know how current events will play out, but we do know this:

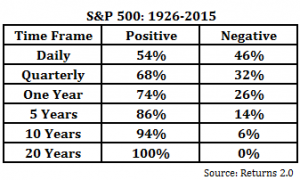

1) The (US) stock market goes up more than it goes down. Do you see now why we emphasize the wisdom of long-term?2) Capital markets have exhibited an upward trajectory over the long-term, yielding positive, inflation-beating returns to those who have stayed put for the ride.

3) If you instead try to time your optimal market exit and entry points, you’ll have to be correct twice to expect to come out ahead; you must get out and back in at the right times.

4) Every trade, whether it works or not, costs real money.

5) Volatility creates opportunity for the long-term investor.

For a longer explanation of #5, see my post from just last week on Strategic Rebalancing. In short, the stock market roller coaster is too unsettling for some investors, who sell when they experience a market lurch. Don’t be ‘that guy.’ However, this does give long-term investors a valuable—and frequent—opportunity to buy stocks on sale. That, in turn, lowers the average cost of the stocks in your portfolio, which can be a boost to your long-term returns.

Ignore the Hype

Please, please, please be smarter than the marketers. Be wary of hyperbolic headlines bearing superlatives such as “the biggest plunge since …” While the numbers may be technically accurate, they are framed to frighten rather than enlighten you, grabbing your attention at the expense of the more boring news on how to simply remain a successful, long-term investor. And they have absolutely nothing to do with whether your personal financial plan is still on track. (Not sure if your plan is on track or not? Send me an email here and I would be happy to talk to you about the tools we use to help answer this question on a daily basis.)

Instead of fretting over meaningless milestones or trying to second-guess what U.S. economics might do to stocks, bonds and inflation, we believe the more important point is this: Market corrections are normal – and essential to generating expected long-term returns. In short, before you consider changing course if the markets continue to decline, of course we hope you’ll be in touch with us first. Oh, and turn off the TV.