July 17, 2018

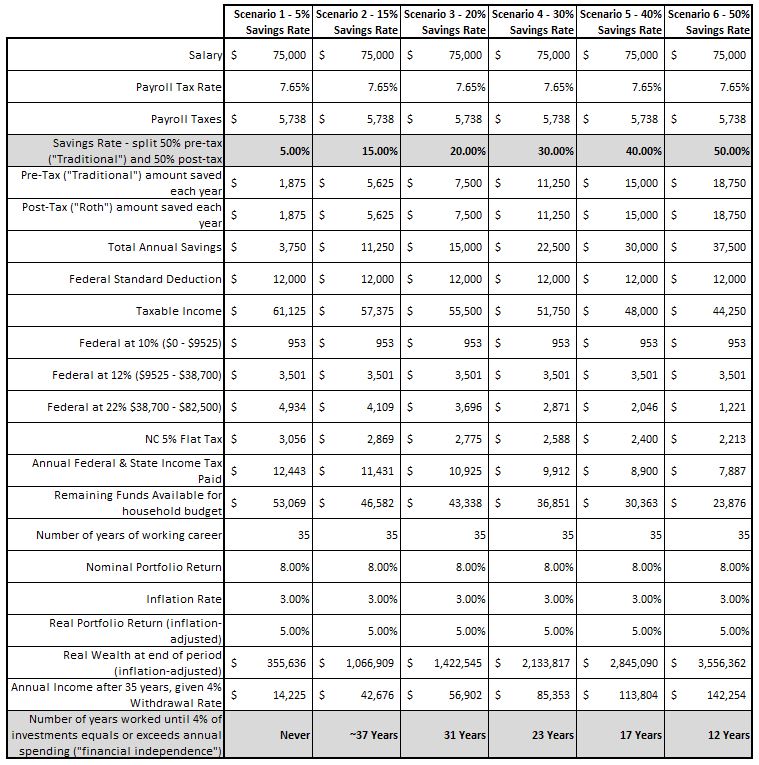

We recently read a Wall Street Journal article called “Five Ways to Improve 401(k)s”, and thought one part of the article, “Raise the default savings rate,” was important enough to justify an entire blog post. In the article, the author discusses the possibility of the federal government encouraging employers to set employees’ default savings rates higher in 401(k)s. WSJ notes that many plans “set initial contribution rates under automatic enrollment at 3% [and]… gradually raise the level to 10%.” The article then says that if instead, contribution rates began at 6% and rose to 15% over time, employees would be in much better shape at retirement.

An obvious question is, is this amount too much, too little, or just right? Like most answers, it depends. How many years do you have until you retire? How much of your previous earnings were you spending?

Another important question to ask is, “What will it take to get there?” Said another way, this question could be phrased, “How much do I need to save to retire?” If you don’t know where the finish line is, you will never know when you cross it.

Introducing the Savings Rate

The good-news answer to this question is, regardless of whatever the federal government does with 401(k) rules, the largest single variable in this equation is under your control. How much you save, as a percentage of your income, is the biggest contributor to the success or failure of your retirement plan. The impact of your savings rate on your retirement plan outweighs the impact of higher returns. And increasing your savings rate is much simpler and more reliable than chasing exceptional returns.

Of course, we can offer endless caveats to this insight. The timing of your savings going into your retirement accounts, when the “good” return years happen, and what the returns environment is like when you begin to take distributions all figure into the probability of success or failure of the plan – basically whether you, the investor, ever run out of money or not. When we run goal-projections for PLC Wealth’s clients, we will use a Monte Carlo simulation software to model the probabilities of various outcomes, but those results cannot be easily shown here. For this article, we will make simplifying assumptions to illustrate the impact of savings rate.

Basic Assumptions

- The only variable we change is savings rate.

- We ignore inflation for salary and expenses, but apply it to the portfolio. All dollar-figures shown are 2018 dollars, and we use a 5% post-inflation rate of return for the portfolio.

- We ignore taxes in the distribution phase.

- We assume the investor can access his or her own or spousal accounts to save this much money in qualified accounts. Even if this last assumption was invalid, the impact of the higher savings rates is still valid even if the savings is done in taxable brokerage accounts.

- We assume 4% is a safe withdrawal rate in perpetuity (we know this assumption is debatable, but we believe this is a helpful jumping-off point).

The Data

Looking at these numbers, we can see where planners get their “save 10% – 15%” mantra. Investors who set aside this amount of money, and receive Social Security, stand a very good chance of retiring successfully at age 65. Additionally, if reported statistics are to be believed, a 10% – 15% savings rate is much higher than the national average.

Notice too that as you raise your savings rate in retirement accounts, the taxing authorities become your partners in growing your wealth. Part of your increased savings is coming directly from tax savings, a fact most investors enjoy.

Raising the Savings Rate

Once families begin hitting savings rates of 20% or more, they put themselves in the position to retire early. Or to downshift at some point in their career. Or to make meaningful gifts to people and organizations they love. Saving 30% of their income, this family lives on $36,851 per year. After thirty-five years, they will have investments capable of supporting annual spending of $85,353 per year – a $48,502 annual income buffer!

In the 5% savings-rate analysis, increasing nominal portfolio returns to 12% results in a portfolio value of $881,718. This portfolio should support about $35,269 in annual withdrawals. A 12% expected return is unrealistic for financial planning projections. And $35,269 per year is considerably lower than the $53,069 this family has been spending. Investors are better served to increase their savings rate to 15% or 20% of your income (or even more), and to anticipate more realistic returns from your portfolio. Then, if your investments do better than expected, you’ll have some extra money to enjoy or give away.

The Benefits of Raising the Savings Rate

As lifespans extend, “spending down” a portfolio until some anticipated terminal date is daunting. With large enough investments and flexible consumption needs, a portfolio becomes a perpetual-motion machine. With sufficient assets and flexible budgeting, your portfolio should continually generate returns that exceed your annual needs in perpetuity. This is a very comfortable position as an investor or retiree.

When you consider your own situation, you may think, “But I don’t have thirty-five years left in my career!”, or, “I don’t have access to employer-sponsored retirement accounts!” Nevertheless, the message to take to heart is: Increasing savings rate increases retirement security. At PLC Wealth, we can help you work through the unique details of your personal situation. In an article like this one, our goal is to raise awareness among investors of tools at their disposal to tilt the odds of retirement success in their favor.

In our experience, increasing your savings rate is the fuel for the fire of achieving and maintaining financial independence. Savings rate rises when you invest more, pay off debt, or grow assets in a private business. No matter where you put the money, it’s this elevated savings rate that can power you to financial independence. It’s a rewarding journey and a worthwhile destination. Happy Investing!