Your Money Trailguide helping you pursue your great adventure now.

Continue readingQ3 Letter to Clients

Quarterly update to clients

Continue readingQuarterly Letter to Clients

Quarterly Letter to Clients

Fee Reductions

Happy New Year! I hope this message finds you well after enjoying the holidays. I just have a quick note to share to start off our new year. A longer post will be coming later this week as our quarterly letter to clients.

2020 was a tough year on many fronts, but one thing it taught us is that market performance in the short term is wildly unpredictable. In addition, short-term performance will likely have a small impact, if any, on your probability of success with your own financial goals. So it is really not worth your mental energy to ever spend a moment worrying about your short term investment performance. Plus, none of us really have any control over investment performance.

What do we have control over? From a planning and investment standpoint, we discuss fees quite often, and look to reduce this financial headwind where possible because this is something we can control. Most of our clients have Dimensional Funds as core holdings in their portfolio, so we were happy to hear this fall that they announced that fees would be reduced across a broad range of their equity funds effective February 2021, representing an approximate 15% reduction on an asset-weighted basis. They were already significantly lower than the average mutual fund expense ratio, so this is a great move in the right direction. It is exciting because it means that, all else equal, our clients will get to keep more of the investment’s returns which will have a compounding effect on wealth over the years.

Reducing fees is only one way to increase your wealth over time. Let us know if you would like to discuss the other planning tools that can be used to increase wealth as well.

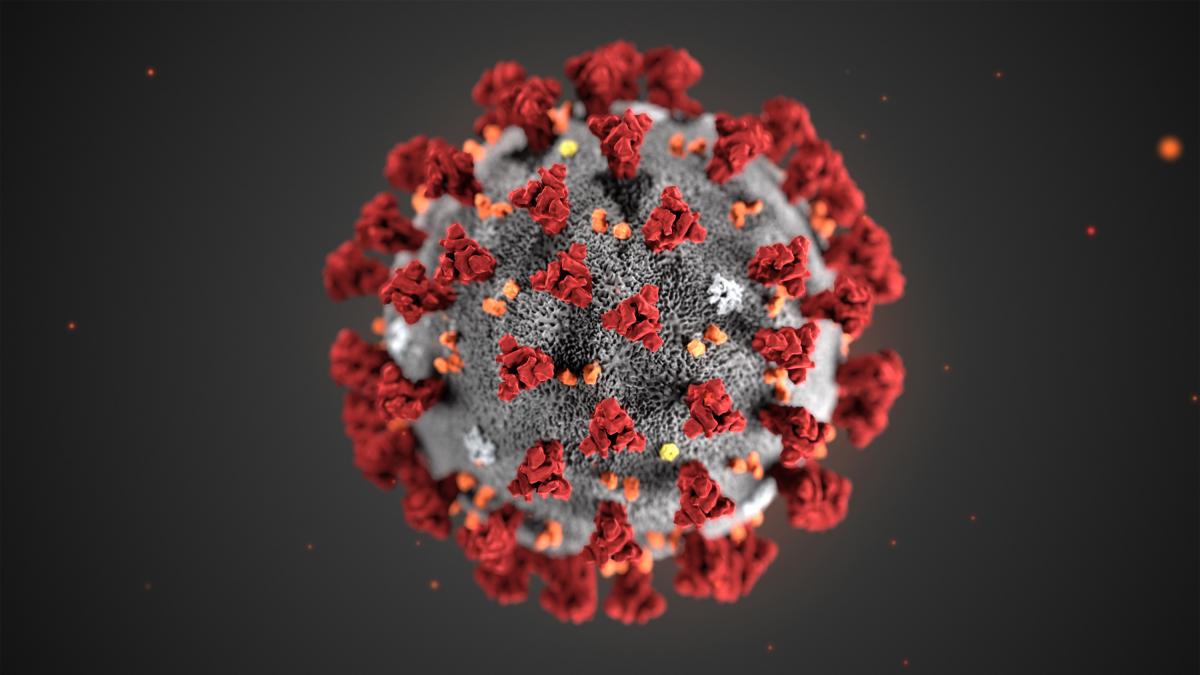

April 2020 – Quarterly Update: Covid-19 Edition

This will be the quarter that we look back on and never forget. It was the time that a virus spread with a silent vengeance, and the world came to a screeching halt. You may be feeling quite disoriented, fearful or even anxious as you read this note since ‘normal’ for all of us has been shaken to its core due to Covid-19. You are likely hunkering down at home, which is what you should do, with little of your regular activities to keep you busy. If you are like me, it literally feels like the earth has stopped spinning on its axis. Up is down, and right is left. Trust me when I say that it is completely normal to feel this way in the context of what we are dealing with as a human species.

I do not come to you with answers or any conclusions that will change the world…there are people that are much smarter than me working on that now, and I have confidence that they will figure it out. But I can bring some encouragement and suggest some small actions that might, just maybe, help us feel like planet earth is starting to rotate once again.

What can you do?

The spread of Covid-19 has impacted the global economy with a speed and impact that is unlike anything seen in our lifetime. This does not mean that happiness and contentment are totally out of your control, however. Mindset is key…start by realizing that the sun still rises every morning like the picture at the top of the article. There is new hope with each new day. I am sure you have found, as have I, that there is now more time to watch movies, read a book, take a distance-appropriate walk to enjoy the spring weather or call someone (yes, actually call them rather than text) to see how they are doing.

If you are sheltering at home with loved ones, you have probably seen them more in the last two weeks than you have for months. We should all continue to do more of these things, and the more we do, the more connected we will stay. I am not a loquacious extrovert, but I have thoroughly enjoyed being around and talking with the ones I care most about. And the more connected we stay, the more human we will feel. This is where happiness and contentment hide, not in your investment portfolio or the latest round of news.

What are we doing?

Actions taken during times of fear in the markets will have implications for years to come. The question is whether they will be positive or negative. For the long-term investors, which are clients that we serve, volatility creates opportunity. We have taken advantage of this opportunity by tax loss harvesting, which allows us to realize the losses for tax savings, but then invest the proceeds right back in something else so the money is never out of the market. The tax savings for our clients this year will be significant. We have also looked to strategically rebalance portfolios. Because some of the fixed income assets have gains over the last year, we have sold those gains to go buy equity funds that are now at a discount. It rebalances the ship and holds to the strategy of selling high and buying low.

What is next?

The fact is, I don’t know. No one does, but that’s OK. We are still waiting on the details of the massive Stimulus bill that was signed into law on March 27th. There are too many details for me to summarize here. If you want a deep dive in to the details, you can find that here. I plan to write more on this soon, but if you have any questions about this, please do not hesitate to call our office. We are all working remotely, but the extensions still ring right to us. Know that we are here to help in this time of uncertainty. Your well-being is of greatest concern to us, and not just financially. Be safe, be smart, and be part of the global solution for everyone by staying home.

We will see you soon,

Josh, Mike, Matt and Sandra

A Covid-19 update from your PLC Wealth team

To say the last couple of weeks have been unexpected, unparalleled and dizzying would still be understating exactly what we have lived through in the last few weeks. Based on further news today (specifically, the Stay at Home Orders issued by Wake County, NC for our local clients), most of us will be sheltering in place for the coming weeks, as we should. I have listened intently, as I am sure you have, to all sides of the discussion that has carried on since the beginning of the outbreak. At this point, the experts are making the case for the seriousness of the virus as it spreads exponentially, and that it is likely that the healthy and optimistic among us could be putting our most vulnerable at risk. Slowing down our movement even further, whether by choice or by requirement, seems to be inevitable for a while longer to give us all the best opportunity to get through this. While we do not know how long this Covid-19 virus will last, I want to take a few moments to speak to you directly about what we are doing as a firm and how you can continue to reach us during these times.

We have implemented many changes in the last couple of weeks as part of our Business Continuity Plan due to Covid-19. Thankfully, we were prepared for a remote working environment, and hopefully you have seen no interruption in the normal service from our team. We have all set up our home workspace. This give us access to our email, phone calls, and client files just as easily as we have them in the office. Our phone service is fully digital which means we can take it with us wherever we go. If you call the office and dial my extension, it will ring my mobile phone. If I call you from my mobile phone, I will be doing so from my office line. We also have a fully digital and secure document management system for our firm which means we can safely access all your files at any time of day from any location in the world. Additionally, all our portfolio management, financial planning and client relationship software is cloud-based and accessible from any location. Believe it or not, it really did not take much time for PLC Wealth to convert to a virtual firm with the same capabilities as when physically in the office.

Now, obviously, there are some challenges. It is impossible to fully replace the face-to-face relationship, both for our internal operations and for our client relationships. We are utilizing a secure and compliant messaging tool for internal communications. While there may be times that we need to access the office, we are attempting to have only a 1-person max in the office at any time. We will also plan to continue with client meetings moving forward through virtual meeting technologies such as Zoom. If you do not have access to a computer for such a meeting, we can still have a conversation the old school way…over the phone…in order to make sure that we do not fall behind in our relationship with each of you. Again, if you need us in the meantime, we are an email or phone call away, just as we have always been.

There are a few logistical items to cover: First, mail will be checked regularly, but maybe not every day. Additionally, we have always made the effort to suggest linking your personal bank account to your brokerage accounts to allow for quick money movements back and forth, should they be necessary. Since we are no longer at the office, a time like this makes it necessary. So, if you need to make an IRA contribution or want to add funds to your brokerage account, we can still do that by an electronic transfer. Getting money from your accounts is just as easy, or we can have a check mailed to you. The bottom line is that getting money from your accounts or to your accounts is just as easy as always. Finally, if you have actual stock certificates, those must be mailed directly to TD for deposit in your account, so just let us know if you need the mailing address.

Unfortunately, times of crisis create opportunities for bad actors. There are already stories of scams coming to the surface, so be prepared and know what to look for:

- – There are no miracle drugs or remedies for Covid-19 at this time so don’t fall for this one. And do not click on any links that may be in an email stating such things, as the link may be another way to inject a virus on your computer.

- – Be very skeptical of any investment ‘opportunities’ with research claims that are no supportable. People will make wild claims to prey on other’s hopes and inability to use the rational brain in times of stress.

- – Never, never, never disclose your social security number, account numbers, or any other piece of Personally Identifiable Information (PII). There are rumors that spam calls and emails are already going out claiming that thsi information is needed to get your piece of the Stimulus bill or a tax refund. Hold on to your PII like you (financial) life depends on it.

- – Generally, just be skeptical in these times of anything that seems too good to be true. If you are not sure, get in touch with us to talk through it.

Let me leave you with a little encouragement in the midst of Covid-19 . Take this time to do something that many of us no longer do naturally on our own…slow down, exercise (by yourself), rest, re-energize, call someone you haven’t spoken with in a while, or binge watch movies with your family that you never have the time for…but mostly, just look around you to see all of the blessings that you inevitably still enjoy. Sometimes, when we are not able or willing to do that which is in our best interest, it is necessary for it to be forced upon us. We find ourselves in one of those times in history. We are a creative and adaptive species so I look forward to hearing about some of the ways that you will get through this…because you will get through this. I will leave you with three pieces of advice that I am confident will be good for you in the long run…Wash your hands, don’t touch your face, and don’t touch your stocks. Know that we are committed to continuing to serve you and your family. We will strive to provide you with an even higher level of service than that which you have come to expect from us. If you need anything at all, even if it is just to have a conversation about the events of the day, please let us know. We are here to help.

Carpe diem,

Josh and the PLC Wealth Team

Donor Advised Funds – Doing good, wisely

July 10, 2018

By Josh Self

No matter how the 2017 Tax Cuts and Jobs Act (TCJA) may alter your tax planning, we’d like to believe one thing will remain the same: With or without a tax write-off, many Americans will still want to give generously to the charities of their choice. After all, financial incentives aren’t usually your main motivation for giving. We give to support the causes we cherish. We give because we’re grateful for the good fortune we’ve enjoyed. We give because generosity is something we value. Good giving feels great – for donor and recipient alike.

That said, a tax break can feel good too, and it may help you give more than you otherwise could. Enter the donor-advised fund (DAF) as a potential tool for continuing to give meaningfully and tax-efficiently under the new tax law.

What’s Changed About Charitable Giving?

To be clear, the TCJA has not eliminated the charitable deduction. You can still take it when you itemize your deductions. But the law has limited or eliminated several other itemized deductions, and it’s roughly doubled the standard deduction (now $12,000 for single and $24,000 for joint filers). With these changes, there will be far fewer times it will make sense to itemize your deductions instead of just taking the now-higher standard allowance, though we believe that with a generally-lower tax burden, many of our clients will have the capacity to give more, not less, due to these tax changes.

This introduces a new incentive to consider batching up your deductible expenses, so they can periodically “count” toward reducing your taxes due – at least in the years you’ve got enough itemized deductions to exceed your standard deduction.

For example, if you usually donate $8,000 annually to charity, you could instead donate $40,000 once every five years. Combined with other deductibles, you might then be able to take a nice tax write-off that year, which may generate (or be generated by) other tax-planning possibilities.

What Can a DAF Do for You?

DAFs are not new; they’ve been around since the 1930s. But they’ve been garnering more attention as a potentially appropriate tax-planning tool under the TCJA. Here’s how they work:

- Make a sizeable donation to a DAF. Donating to a DAF, which acts like a “charitable bank,” is one way to batch up your deductions for tax-wise giving. But remember: DAF contributions are irrevocable. You cannot change your mind and later reclaim the funds.

- Deduct the full amount in the year you fund the DAF. DAFs are established by nonprofit sponsoring organizations, so your entire contribution is available for the maximum allowable deduction in the year you make it. Plus, once you’ve funded a DAF, the sponsor typically invests the assets, and any returns they earn are tax-free. This can give your initial donation more giving-power over time.

- Participate in granting DAF assets to your charities of choice. Over time, and as the name “donor-advised fund” suggests, you get to advise the DAF’s sponsoring organization on when to grant assets, and where those grants will go.

Thus, donating through a DAF may be preferred if you want to make a relatively sizeable donation for tax-planning or other purposes; you’d like to retain a say over what happens next to those assets; and you’re not yet ready to allocate all the money to your favorite causes.

Another common reason people turn to a DAF is to donate appreciated assets, such as real estate or stocks in kind (without selling them first), when your intended recipients can only accept cash/liquid donations. The American Endowment Foundation offers this 2015 “Donor Advised Fund Summary for Donors,” with additional reasons a DAF may appeal – with or without its newest potential tax benefits.

Beyond DAFs

A DAF isn’t for everyone. Along the spectrum of charitable giving choices, they’re relatively easy and affordable to establish, while still offering some of the benefits of a planned giving vehicle. As such, they fall somewhere between simply writing a check, versus taking on the time, costs and complexities of a charitable remainder trust, charitable lead trust, or private foundation. If it is appropriate for your situation, we are happy to discuss planned giving vehicles with you too.

How Do You Differentiate DAFs?

If you decide a DAF would be useful to your cause, and might be a helpful part of your financial plan, the next step is to select an organization to sponsor your contribution. Sponsors typically fall into three types:

- Public charities established by financial providers, like Fidelity, Schwab and Vanguard

- Independent national organizations, like the American Endowment Foundation and National Philanthropic Trust

- “Single issue” entities, like religious, educational or emergency aid organizations

Within and among these categories, DAFs are not entirely interchangeable. Whether you’re being guided by a professional advisor or you’re managing the selection process on your own, it’s worth doing some due diligence before you fund a DAF. Here are some key considerations:

Minimums – Different DAFs have different minimums for opening an account. For example, one sponsor may require $5,000 to get started, while another may have a higher threshold.

Fees – As with any investment account, expect administration fees. Just make sure they’re fair and transparent, so they don’t eat up all the benefits of having a DAF to begin with.

Acceptable Assets – Most DAFs will let you donate cash as well as stocks. Some may also accept other types of assets, such as real estate, private equity or insurance.

Grant-Giving Policies – Some grant-giving policies are more flexible than others. For example, single-entity organizations may require that a percentage of your grants go to their cause, or only to local or certain kinds of causes. Some may be more specific than others on the minimum size and/or maximum frequency of your grant requests. Some have simplified the grant-making process through online automation; others have not.

Investment Policies – DAF assets are typically invested in the market, so they can grow tax-free over time. But some investments are far more advisable than others for building long-term giving power! How much say will you have on investment selections? If you’re already working with a wealth advisor, it can make good sense to choose a DAF that lets your advisor manage these account assets in a prudent, fiduciary manner. PLC Wealth employs an evidence-based investment strategy for all our managed assets.

Transfer and Liquidation Policies – What happens to your DAF account when you die? Some sponsors allow you to name successors if you’d like to continue the account in perpetuity. Some allow you to name charitable organizations as beneficiaries. Some have a formula for distributing assets to past grant recipients. Some will roll the assets into their own endowment. (Most will at least do this as a last resort if there are no successors or past grant recipients.) Also, what if you decide you’d like to transfer your DAF to a different sponsoring organization during your lifetime? Find out if the organization you have in mind permits it.

Deciding on Your Definitive DAF

Selecting an ideal DAF sponsor for your tax planning and charitable intent usually involves a process of elimination. To narrow the field, decide which DAF features matter the most to you, and which ones may be deal breakers.

If you’re working with a wealth advisor such as PLC Wealth Management, we hope you’ll lean on us to help you make a final selection, and meld it into your greater personal and financial goals. As Wharton Professor and “Give and Take” author Adam Grant has observed, “The most meaningful way to succeed is to help others succeed.” That’s one reason we’re here: to help you successfully incorporate the things that last – like generosity – into your lifestyle.

Tune out the noise…

This short video from our friends at Dimensional Fund Advisors is worth a couple minutes of your time…view Tuning Out the Noise here. It highlights one of the ways that we, as advisers, aspire to bring value to our clients lives. It is also a friendly reminder to focus on what matters, and ignore the rest.

Reflections on 2018 and the stock markets renewed volatility…

If you were a member of the popular press, you’d probably be happy with 2018’s first quarter performance. At last – some volatility fueling news1 in early February, with plenty of enticing “largest,” “fastest,” and “worst” market superlatives to savor after a long, languid lull.

As usual, there are plenty of potential culprits to point to among current events: global trade wars heating up, the arrival of quantitative tightening (rising interest rates), troubles in tech-land over data privacy concerns, ongoing Brexit talks, and some interesting events over in the Koreas. At quarter-end, one hopeful journalist asked, “Is the Bear Market Here Yet?”2 Another observed: “[T]he number of [Dow Jones Industrial Average] sessions with a 1% move so far in 2018 are more than double 2017’s tally, and it isn’t even April.”3

Has the coverage left you wondering about your investments? Most markets have been steaming ahead so well for so long, even a modest misstep may have you questioning whether you should “do something,” in case the ride gets rougher still.

If we’ve done our job of preparing clients and their portfolio for market jitters, clients may might be able to cite back to us why they’ve already done all they can do to manage the volatility, and why it’s ultimately expected to be good news for evidence-based investors anyway. Remember, if there were never any real market risk, you couldn’t expect extra returns for your risk tolerance.

That said, you may have forgotten – or never experienced – how awful the last round of extreme volatility felt during the Great Recession. Insights from behavioral finance tell us that our brain’s ingrained biases cause us to gloss over those painful times, and panic all over again when they recur, long before our rational resolve has time to kick in.

If you noticed the news, but you’re okay with where you’re at, that’s great. If the volatility is bothering you, talk to a CFP® professional or other qualified financial professional; it may help ease your angst. If you continue to struggle with whether you made the right decisions during quieter markets, plan a rational shift to better reflect your real risk tolerances and cash-flow requirements. Not only is your peace of mind at least as important as the dollars in your account, you could end up worse off if you’ve taken on more risk than you can bear in pursuit of higher expected returns.

As Wall Street Journal columnist Jason Zweig said during the February dip: “A happy few investors … may have long-term thinking built into them by nature. The rest of us have to cultivate it by nurture.” We couldn’t agree more, and we consider it our duty and privilege to advise you accordingly, through every market hiccup.