Quarterly update to clients

Continue readingQ3 Letter to Clients

Quarterly update to clients

Continue readingQuarterly Letter to Clients

Quarterly Letter to Clients

Open letter regarding current events…

To our clients, friends, and colleagues,

We hope this note finds you well in the midst of turbulent times. We want to recognize the difficulty of the past couple of weeks; in fact, 2020 has been a hard year for almost everyone. As a firm, PLC Wealth is devastated to see the haphazard destruction of life, the mindless assault on personal livelihoods and property, and the highlighted human suffering. We stand with all those on the side of liberty and justice, affirming the American declaration ‘that all men are created equal.’ We hope you all stay safe and healthy in these uncertain times, and as always, please let us know if there is anything that we can do to help.

Your PLC Wealth Team

How will the CARES Act impact you?

There is a good chance that you have more unscheduled time these days as almost every state in the union moves to a stay-at-home orders, but have you used this extra time to read the full H.R. 748 Coronavirus Aid, Relief, and Economic Security Act, or CARES Act? If you would rather use this newly found time in other ways, here is a time-saving summary of the CARES Act looking at 9 different provisions that may impact you. This is a longer post than normal, but is formatted so that you can scan through pretty quickly to sections that are more relevant to you. If you have any questions whatsoever, please be in touch!

CARES Act In General

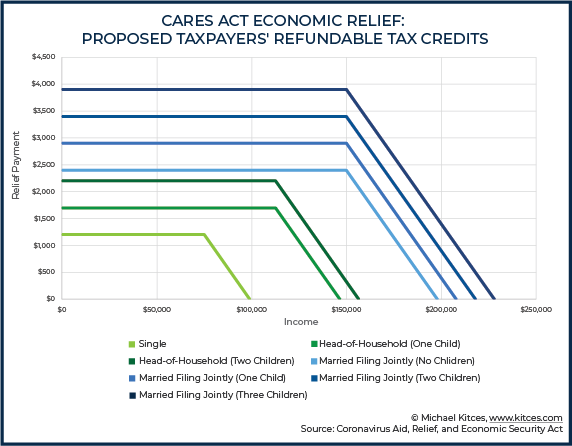

- Direct payments/recovery rebates: Most Americans can expect to receive rebates from Uncle Sam. Depending on your household income, expect up to $1,200 per adult and $500 per dependent child. To calculate your payment, the Federal government will look at your 2019 Adjusted Gross Income (AGI) if it’s available, or your 2018 AGI if it’s not. However, you’ll receive an extra 2020 tax credit if your 2020 AGI ends up lower than the figure used to calculate your rebate. This Nerd’s Eye View illustration offers a great overview:

From Michael Kitces at Nerd’s Eye View; reprinted with permission

- Retirement account distributions for coronavirus-related needs: You can tap into your retirement account ahead of time in 2020 for a coronavirus-related distribution of up to $100,000, without incurring the usual 10% penalty or mandatory 20% Federal withholding. Please note that this is not a waiver of income tax on the distributions, but does allow you to prorate the payment across 3 years. You also can repay distributions to your account within 3 years to avoid paying income taxes, or to claim a refund on taxes paid. There are some landmines here so be careful to follow the rules exactly should you tap in to your 401k.

- Various healthcare-related incentives: For example, certain over-the-counter medical expenses previously disallowed under some healthcare plans now qualify for coverage. This also allows for expanded use of tax free money from an HSA. Also, Medicare restrictions have been relaxed for covering telehealth and other services (such as COVID-19 vaccinations, once they’re available). Other details apply.

CARES Act For Retirees (and Retirement Account Beneficiaries)

- RMD relief: Required Minimum Distributions (RMDs) are taking a much needed break in 2020 for those meeting the new age requirements, as well as beneficiaries with inherited retirement accounts. If you’ve not yet taken your 2020 RMD, don’t! Let’s talk about other options. If you have taken a distribution, please be in touch quickly with us so that we can explore potential remedies.

CARES Act For Charitable Donors

- “Above-the-line” charitable deductions: Deduct up to $300 in 2020 qualified charitable contributions (excluding Donor Advised Funds), even if you are taking a standard deduction. Not much here, but it is worth noting to save a little bit in taxes.

- Donate all of your 2020 AGI: You can effectively eliminate 2020 taxes owed, and then some, by donating up to, or beyond your AGI. If you donate more than your AGI, you can carry forward the excess up to 5 years. One big caveat: Donor Advised Fund contributions are excluded.

CARES Act For Business Owners (and Certain Not-for-Profits)

- Paycheck Protection Program loans (potentially forgivable): The Small Business Administration (SBA) Paycheck Protection Program (PPP) is making loans available for qualified businesses and not-for-profits (typically under 500 employees), sole proprietors, and independent contractors. Loans for up to 2.5x monthly payroll, up to $10 million, 2-year maturity, interest rate 1%. Payments are deferred and, if certain employment retention and other requirements are met, the loan may be forgiven. The program was set to open up today, April 3, but as of this writing, there is still much up in the air about the actual implementation. If you haven’t already, touch base with your banker as soon as you can.

- Economic Injury Disaster Loans (with forgivable advance): In coordination with your state, SBA disaster assistance also offers Economic Injury Disaster Loans (EIDLs) of up to $2 million to qualified small businesses and non-profits, “to help overcome the temporary loss of revenue they are experiencing.” Interest rates are under 4%, with potential repayment terms of up to 30 years. Applicants also are eligible for an advance on the loan of up to $10,000. The advance will not need to be repaid, even if the loan is denied.

- Payroll tax credits and deferrals: For qualified businesses who are not taking a loan.

- Employee retention credit: An additional employee retention credit (as a payroll tax credit), “equal to 50 percent of the qualified wages with respect to each employee of such employer for such calendar quarter.” Excludes businesses receiving PPP loans, and may exclude those who have taken the EIDL loans.

- Net Operating Loss rules relaxed: Carry back 2018–2020 losses up to five years, on up to 100% of taxable income from these same years.

- Immediate expensing for qualified improvements: Section 168 of the Internal Revenue Code of 1986 is amended to allow immediate expensing rather than multi-year depreciation.

- Dollars set aside for industry-specific relief: Please be in touch for a more detailed discussion if your entity may be eligible for industry-specific relief (e.g., airlines, hospitals and state/local governments).

CARES Act For Employees/Plan Participants

- Retirement plan loans and distributions: Maximum amount increased to $100,000 on up to the entire vested amount for coronavirus-related loans. Delay repayment up to a year for loans taken from March 27–year-end 2020. Distributions described above in In General.

- Paid sick leave: Paid sick leave benefits for COVID-19 victims are described in the separate, March 18 R. 6201 Families First Coronavirus Response Act, and are above and beyond any benefits received through the CARES Act. Whether in your role as an employer or an employee, we’re happy to discuss the details with you upon request.

CARES Act For Employers/Plan Sponsors

- Relief for funding defined benefit plans: Due date for 2020 funding is extended to Jan. 1, 2021. Also, the funding percentage (AFTAP) can be calculated based on your 2019 status.

- Relief for facilitating pre-retirement plan distributions and expanded loans: As described above for Employees/Plan Participants, employers “may rely on an employee’s certification that the employee satisfies the conditions” to be eligible for relief. The participant is required to self-certify in writing that they or a direct dependent have been diagnosed, or they have been financially impacted by the pandemic. No additional evidence (such as a doctor’s release) is required.

- Potential extension for filing Form 5500: While the Dept. of Labor (DOL) has not yet granted an extension, the CARES Act permits the DOL to postpone this filing deadline.

- Exclude student loan pay-down compensation: Through year-end, employers can help employees pay off current educational expenses and/or student loan balances, and exclude up to $5,250 of either kind of payment from their income. If you have a student loan, talk to your employer about this provision. And also pay attention to the For Students section below.

CARES Act For Unemployed/Laid Off Americans

- Increased unemployment compensation: Federal funding increases standard unemployment compensation by $600/week, and coverage is extended 13 weeks. If you have lost your job, apply immediately.

- Federal funding covers first week of unemployment: The one-week waiting period to start collecting benefits is waived. Again, if you have lost your job, apply immediately.

- Pandemic unemployment assistance: Unemployment coverage is extended to self-employed individuals for up to 39 weeks. Plus, the Act offers incentives for states to establish “short-time compensation programs” for semi-employed individuals.

CARES Act For Students

- Student loan payments deferred to Sept. 30, 2020: No interest will accrue either. Important: Voluntary payments will continue unless you explicitly pause them. Plus, the deferral period will still count toward any loan forgiveness program you’re in. So, be sure to pause payments if this applies to you, lest you pay on debt that will ultimately be forgiven.

- Delinquent debt collection suspended through Sept. 30, 2020: Including wage, tax refund, and other Federal benefit garnishments.

- Employer-paid student loan repayments excluded from 2020 income: From the date of the CARES Act enactment through year-end, your employer can pay up to $5,250 toward your student debt or your current education without it counting as taxable income to you.

- Pell Grant relief: There are several clauses that ease Pell Grant limits, while not eliminating them. It would be best if we go over these with you in person if they may apply to you.

CARES Act For Estates/Beneficiaries

- A break for “non-designated” beneficiaries: 2020 can be ignored when applying the 5-year rule for “non-designated” beneficiaries with inherited retirement accounts. The 5-Year Rule effectively ends up becoming a 6-Year Rule for current non-designated beneficiaries. This is still going to be tricky, so please contact us before taking any further distributions from an inherited retirement account.

======================================================================================================================================

Now you are familiar with much of the critical content of the CARES Act! That said, given the complexities involved and unprecedented current conditions, there will undoubtedly be updates, clarifications, additions, system glitches, and other adjustments to these summary points. The results could leave a wide gap between intention and reality. As such, before proceeding, please consult with us and other appropriate professionals, such as your accountant, and/or attorney on any details specific to you. Please don’t hesitate to reach out to us with your questions and comments. We look forward to hearing from you soon!

Josh, Mike, Matt, and Sandra

Reference Materials:

-

DWC News Update, The CARES Act: Federal Coronavirus Relief. March 30, 2020.

-

Financial Planning, “Major changes in RMDs and retirement contributions in $2T stimulus plan,” Ed Slott, March 27, 2020.

-

H2R CPA, “Cares Act will provide billions of dollars of relief,” March 27, 2020.

-

R. 748: Coronavirus Aid, Relief, and Economic Security (CARES) Act.

-

Nerd’s Eye View, “Analyzing The CARES Act: From Rebate Checks To Small Business Relief For The Coronavirus Pandemic,” Jeffrey Levine, March 27, 2020.

-

The Wall Street Journal, “How the Coronavirus Paid Leave Rules Apply to You,” Charity L. Scott, March 27, 2020.

-

ThinkAdvisor, “3 Stimulus Bill Provisions Advisors Should Act On Now: Jeff Levine,” Jeff Berman, March 30, 2020.

-

S. Chamber of Commerce, “Coronavirus Emergency Loans Small Business Guide and Checklist.”

-

S. Small Business Administration, Paycheck Protection Program and Disaster Assistance.

April 2020 – Quarterly Update: Covid-19 Edition

This will be the quarter that we look back on and never forget. It was the time that a virus spread with a silent vengeance, and the world came to a screeching halt. You may be feeling quite disoriented, fearful or even anxious as you read this note since ‘normal’ for all of us has been shaken to its core due to Covid-19. You are likely hunkering down at home, which is what you should do, with little of your regular activities to keep you busy. If you are like me, it literally feels like the earth has stopped spinning on its axis. Up is down, and right is left. Trust me when I say that it is completely normal to feel this way in the context of what we are dealing with as a human species.

I do not come to you with answers or any conclusions that will change the world…there are people that are much smarter than me working on that now, and I have confidence that they will figure it out. But I can bring some encouragement and suggest some small actions that might, just maybe, help us feel like planet earth is starting to rotate once again.

What can you do?

The spread of Covid-19 has impacted the global economy with a speed and impact that is unlike anything seen in our lifetime. This does not mean that happiness and contentment are totally out of your control, however. Mindset is key…start by realizing that the sun still rises every morning like the picture at the top of the article. There is new hope with each new day. I am sure you have found, as have I, that there is now more time to watch movies, read a book, take a distance-appropriate walk to enjoy the spring weather or call someone (yes, actually call them rather than text) to see how they are doing.

If you are sheltering at home with loved ones, you have probably seen them more in the last two weeks than you have for months. We should all continue to do more of these things, and the more we do, the more connected we will stay. I am not a loquacious extrovert, but I have thoroughly enjoyed being around and talking with the ones I care most about. And the more connected we stay, the more human we will feel. This is where happiness and contentment hide, not in your investment portfolio or the latest round of news.

What are we doing?

Actions taken during times of fear in the markets will have implications for years to come. The question is whether they will be positive or negative. For the long-term investors, which are clients that we serve, volatility creates opportunity. We have taken advantage of this opportunity by tax loss harvesting, which allows us to realize the losses for tax savings, but then invest the proceeds right back in something else so the money is never out of the market. The tax savings for our clients this year will be significant. We have also looked to strategically rebalance portfolios. Because some of the fixed income assets have gains over the last year, we have sold those gains to go buy equity funds that are now at a discount. It rebalances the ship and holds to the strategy of selling high and buying low.

What is next?

The fact is, I don’t know. No one does, but that’s OK. We are still waiting on the details of the massive Stimulus bill that was signed into law on March 27th. There are too many details for me to summarize here. If you want a deep dive in to the details, you can find that here. I plan to write more on this soon, but if you have any questions about this, please do not hesitate to call our office. We are all working remotely, but the extensions still ring right to us. Know that we are here to help in this time of uncertainty. Your well-being is of greatest concern to us, and not just financially. Be safe, be smart, and be part of the global solution for everyone by staying home.

We will see you soon,

Josh, Mike, Matt and Sandra

Good advice is simple – but not easy!

Here in North Carolina, we cope with hurricanes from time to time, and like the storms, financial markets can bring bumpy weather to our investment portfolios.

However, unlike with hurricanes, which are typically in the forecast for several days at least, no one can truly see over the horizon to know when bad times – a big drop in asset values – may affect our investments. When that happens, it is more important than ever to have, and to follow, a solid financial plan.

Sometimes the best, most rigorously developed financial advice is so obvious, it’s become cliché. And yet, investors often end up abandoning this same advice when market turbulence is on the rise. Why the disconnect? Let’s take a look at five of the most familiar financial adages, and why they’re often much easier said than done.

- If you fail to plan, you plan to fail.

- No risk, no reward.

- Don’t put all your eggs in one basket.

- Buy low, sell high.

- Stay the course.

We’ll explore each in turn, how we implement them, and why helping people stick with these evidence-based basics remains among our most important and challenging roles.

-

If You Fail to Plan, You Plan to Fail.

Almost everyone would agree: It makes sense to plan how and why you want to invest before you actually do it. And yet, few investors come to us with robust plans already in place. That’s why deep, extensive and multilayered planning is one of the first things we do when welcoming a new client, including:

- A Discovery Meeting – To understand everything about you, including your goals and interests, your personal and professional relationships, your values and beliefs, how you’d prefer to work with us … and anything else that may be on your mind.

- “Traditional” Financial Planning – To organize your existing assets and liabilities, define your near-, mid-, and long-range goals, and ensure your financial means align as effectively as possible with your most meaningful aspirations.

- An Investment Policy Statement (IPS) – To bring order to your investment universe. Your IPS is both your plan and your pledge to yourself on how your investments will be structured to best align with your greater goals. It describes your preferred asset allocations (such as your percentage of stocks vs. bonds), and is further shaped by your willingness, ability, and need to tolerate market risks in pursuit of desired returns.

- Integrated Wealth Management – To chart a course for aligning your range of wealth interests with your financial logistics: insurance, estate planning, tax planning, business succession, philanthropic intent and more.

As we’ll explore further, even solid planning doesn’t guarantee success. But we believe the only way we can accurately assess how you’re doing is if we’ve first identified what you’re trying to achieve, and how we expect to accomplish it.

-

No Risk, No Reward.

In many respects, the relationship between risk and reward serves as the wellspring from which a steady stream of financial economic theory has flowed ever since. Simply put, exposing your portfolio to market risk is expected to generate higher returns over time. Reduce your exposure to market risk, and you also lower expected returns.

We typically build a measure of stock market exposure into our clients’ portfolios accordingly, with specific allocations guided by individual goals and risk tolerances. But here’s the thing: Once you have accepted the evidence describing how market risks and expected returns are related, it’s critical that you remain invested as planned.

There’s ample evidence that periodic market downturns ranging from “ripples” to “rapids” are part of the ride. As a February 2018 Vanguard report described, from 1980–2017, the MSCI World Index recorded 11 market corrections of 10% or more, and 8 bear markets with at least 20% declines lasting at least 2 months. Such risks ultimately shape the stream that is expected to carry you to your desired destination. Consider them part of your journey.

-

Don’t Put All Your Eggs in One Basket.

At the same time, “risk” is not a mythical unicorn. It’s real. If it rears up, it can trample your dreams. So, just because you might need to include riskier sources of expected returns in your portfolio, it does not mean you must give them free rein.

This is where diversification comes in. Diversification is nothing new. In 1990, Harry Markowitz was co-recipient of a Nobel prize for his work on what became known as Modern Portfolio Theory. Markowitz analyzed (emphasis ours) “how wealth can be optimally invested in assets which differ in regard to their expected return and risk, and thereby also how risks can be reduced.” In other words, according to Markowitz’s work, first published in 1952, investors should employ diversification to manage portfolio risks.

This leads to an intriguing, evidence-based understanding. By combining widely diverse sources of risk, it’s possible to build more efficient portfolios. You can:

- EITHER lower a portfolio’s overall risk exposure while maintaining similar expected returns

- OR maintain similar levels of portfolio risk exposure while improving overall expected returns

Rarely, evolving evidence helps us identify additional or shifting sources of expected return worth blending into your existing plans. When this occurs, and only after extensive due diligence, we may advise you to do so, if practical (and cost-effective) solutions exist.

The details of how these risk/return “levers” work is beyond the scope of this article. But come what may, the desire and necessity to DIVERSIFY your portfolio remains as important as ever – not only between stocks and bonds, but across multiple, global sources of expected returns.

-

Buy Low, Sell High.

Of course, every investor hopes to sell their investments for more than they paid for them. Here are two best practices to help you succeed where so many fall short: time and rebalancing.

Time

By building a low-cost, broadly diversified portfolio, and letting it ride the waves of time, all evidence suggests you can expect to earn long-term returns that roughly reflect your built-in risk exposure. But “success” often takes a great deal more time than most investors allow for.

In a recent article, financial author Larry Swedroe looked at performance persistence among six different sources of expected return as well as three model portfolios built from them. He found, “In each case, the longer the horizon, the lower the odds of underperformance.” However, he also observed, “one of the greatest problems preventing investors from achieving their financial goals is that, when it comes to judging the performance of an investment strategy, they believe that three years is a long time, five years is a very long time and 10 years is an eternity.”

In the market, 10 years is not long. You must be prepared to remain true to your carefully structured portfolio for years if not decades, so we typically ensure that an appropriate portion is sheltered from market risks and is relatively accessible (liquid). The riskier portion can then be left to ebb, flow and expectedly grow over expanses of time, without the need to tap into it in the near-term. In short, time is only expected to be your friend if you give it room to run.

Portfolio Rebalancing

Another way to buy low and sell high is through disciplined portfolio rebalancing. As we create a new portfolio, we prescribe how much weight to allocate to each holding. Over time, these holdings tend to stray from their original allocations, until the portfolio is no longer invested according to plan. By periodically selling some of the holdings that have overshot their ideal allocation, and buying more of the ones that have become underrepresented, we can accomplish two goals: Returning the portfolio closer to its intended allocations, AND naturally buying low (recent underperformers) and selling high (recent outperformers).

-

Stay the Course.

So, yes, planning and maintaining an evidence-based investment portfolio is important. But even the best-laid plans will fail you, if you fail to follow them. Here, we get to the heart of why even “obvious” advice is often easier said than done. Our rational self may know better – but our instincts, emotions and behavioral biases get in the way.

Three particularly important biases to be aware of in volatile markets include tracking-error regret, recency bias, and outcome bias.

Tracking-Error Regret

When we build your portfolio, we typically structure it to reflect your goals and risk tolerances, by diversifying across different sources of expected risks and returns. Each part is expected to contribute to the portfolio’s unique whole by performing differently from its counterparts during different market conditions. Each portfolio may perform very differently from popular “norms” or benchmarks like the S&P 500 … for better or worse.

When “worse” occurs, and especially if it lingers, you are likely to feel tracking-error regret – a gnawing doubt that comes from comparing your own portfolio’s returns to popular benchmarks, and wishing yours were more like theirs.

Remember this: By design, your factor-based, globally diversified portfolio is highly likely to march out of tune with typical headline returns. It can be deeply damaging to your plans if you compare your own performance to benchmarks such as the general market, the latest popular trends, or your neighbor’s seemingly greener financial grass.

Recency

Recency causes us to pay more attention to our latest experiences, and to downplay the significance of long-term conditions. When an expected source of return fails to deliver, especially if the disappointment lasts for a while, you may start to second-guess the long-term evidence. This can trigger what Nobel laureate and behavioral economist Daniel Kahneman describes as “what you see is all there is” mistakes.

Again, buying high and selling low is exactly the opposite of your goals. And yet, recency causes droves of investors to chase hot, high-priced holdings and sell low during declines. Irrational choices based on recency may still turn out okay if you happen to get lucky. But they detour you from the most rational, evidence-based course toward your goals.

Outcome Bias

Sometimes, even the most rational plans don’t turn out as hoped for. If you let outcome bias creep in, you end up blaming the plan itself, even if it was simply bad luck. This, in turn, causes you to abandon your plan. Unfortunately, it’s rarely replaced with a better plan, which brings us back to our first adage about those who fail to plan.

To illustrate, let’s say, several years ago, we created a solid investment plan and IPS for you. At the time, you felt confident about them. Since then, we’ve periodically refreshed your plan, based on your evolving personal goals, perhaps a few new academic insights, and any new resources now available for further optimizing your portfolio.

Now, let’s say the markets disappoint us over the next few years. Ugly red numbers take over your reports, seemingly forever. Before you conclude your underlying strategy is wrong, remember: It’s far more likely you’re experiencing outcome bias (with a recency-bias chaser).

Investing will always contain an element of random luck. From that perspective, in largely efficient markets, your best course remains – you guessed it – to stay the course with your existing, carefully crafted plans. While even evidence-based investing doesn’t guarantee success, it continues to offer your best odds moving forward. Don’t lose faith in it.

Simple, But Not Easy

Let’s wrap with a telling anecdote. Merton Miller was another co-recipient of the aforementioned 1990 Nobel prize. Miller’s portion was in recognition of his “fundamental contributions to the theory of corporate finance.” While his findings were deep and far-reaching, he once summarized them as follows:

[I]f you take money out of your left pocket and put it in your right pocket, you’re no richer. Reporters would say, ‘you mean they gave you guys a Nobel Prize for something as obvious as that?’ … And I’d add, ‘Yes, but remember, we proved it rigorously.’”

Like Miller’s light take on his heavy-duty findings, some of what we feel is our best advice seems so simple. And yet, in our experience, it’s very hard to adhere to this same, “obvious” advice in the face of market turbulence.

Blame your behavioral biases. They make simple advice deceptively difficult to follow. We all have them, including blind spot bias. That is, we can easily tell when someone else is succumbing to a behavioral bias, but we routinely fail to recognize when it’s happening to us.

This is one reason it’s essential to have an objective, professional advisor (along with your network of informal advisors) who is willing and able to let you know when you’re falling victim to a bias you cannot see in the mirror. At PLC Wealth, that is exactly what we are here for! Let us know if we can help you reflect on these or any other challenges that stand between you and your greatest financial goals.

Donor Advised Funds – Doing good, wisely

July 10, 2018

By Josh Self

No matter how the 2017 Tax Cuts and Jobs Act (TCJA) may alter your tax planning, we’d like to believe one thing will remain the same: With or without a tax write-off, many Americans will still want to give generously to the charities of their choice. After all, financial incentives aren’t usually your main motivation for giving. We give to support the causes we cherish. We give because we’re grateful for the good fortune we’ve enjoyed. We give because generosity is something we value. Good giving feels great – for donor and recipient alike.

That said, a tax break can feel good too, and it may help you give more than you otherwise could. Enter the donor-advised fund (DAF) as a potential tool for continuing to give meaningfully and tax-efficiently under the new tax law.

What’s Changed About Charitable Giving?

To be clear, the TCJA has not eliminated the charitable deduction. You can still take it when you itemize your deductions. But the law has limited or eliminated several other itemized deductions, and it’s roughly doubled the standard deduction (now $12,000 for single and $24,000 for joint filers). With these changes, there will be far fewer times it will make sense to itemize your deductions instead of just taking the now-higher standard allowance, though we believe that with a generally-lower tax burden, many of our clients will have the capacity to give more, not less, due to these tax changes.

This introduces a new incentive to consider batching up your deductible expenses, so they can periodically “count” toward reducing your taxes due – at least in the years you’ve got enough itemized deductions to exceed your standard deduction.

For example, if you usually donate $8,000 annually to charity, you could instead donate $40,000 once every five years. Combined with other deductibles, you might then be able to take a nice tax write-off that year, which may generate (or be generated by) other tax-planning possibilities.

What Can a DAF Do for You?

DAFs are not new; they’ve been around since the 1930s. But they’ve been garnering more attention as a potentially appropriate tax-planning tool under the TCJA. Here’s how they work:

- Make a sizeable donation to a DAF. Donating to a DAF, which acts like a “charitable bank,” is one way to batch up your deductions for tax-wise giving. But remember: DAF contributions are irrevocable. You cannot change your mind and later reclaim the funds.

- Deduct the full amount in the year you fund the DAF. DAFs are established by nonprofit sponsoring organizations, so your entire contribution is available for the maximum allowable deduction in the year you make it. Plus, once you’ve funded a DAF, the sponsor typically invests the assets, and any returns they earn are tax-free. This can give your initial donation more giving-power over time.

- Participate in granting DAF assets to your charities of choice. Over time, and as the name “donor-advised fund” suggests, you get to advise the DAF’s sponsoring organization on when to grant assets, and where those grants will go.

Thus, donating through a DAF may be preferred if you want to make a relatively sizeable donation for tax-planning or other purposes; you’d like to retain a say over what happens next to those assets; and you’re not yet ready to allocate all the money to your favorite causes.

Another common reason people turn to a DAF is to donate appreciated assets, such as real estate or stocks in kind (without selling them first), when your intended recipients can only accept cash/liquid donations. The American Endowment Foundation offers this 2015 “Donor Advised Fund Summary for Donors,” with additional reasons a DAF may appeal – with or without its newest potential tax benefits.

Beyond DAFs

A DAF isn’t for everyone. Along the spectrum of charitable giving choices, they’re relatively easy and affordable to establish, while still offering some of the benefits of a planned giving vehicle. As such, they fall somewhere between simply writing a check, versus taking on the time, costs and complexities of a charitable remainder trust, charitable lead trust, or private foundation. If it is appropriate for your situation, we are happy to discuss planned giving vehicles with you too.

How Do You Differentiate DAFs?

If you decide a DAF would be useful to your cause, and might be a helpful part of your financial plan, the next step is to select an organization to sponsor your contribution. Sponsors typically fall into three types:

- Public charities established by financial providers, like Fidelity, Schwab and Vanguard

- Independent national organizations, like the American Endowment Foundation and National Philanthropic Trust

- “Single issue” entities, like religious, educational or emergency aid organizations

Within and among these categories, DAFs are not entirely interchangeable. Whether you’re being guided by a professional advisor or you’re managing the selection process on your own, it’s worth doing some due diligence before you fund a DAF. Here are some key considerations:

Minimums – Different DAFs have different minimums for opening an account. For example, one sponsor may require $5,000 to get started, while another may have a higher threshold.

Fees – As with any investment account, expect administration fees. Just make sure they’re fair and transparent, so they don’t eat up all the benefits of having a DAF to begin with.

Acceptable Assets – Most DAFs will let you donate cash as well as stocks. Some may also accept other types of assets, such as real estate, private equity or insurance.

Grant-Giving Policies – Some grant-giving policies are more flexible than others. For example, single-entity organizations may require that a percentage of your grants go to their cause, or only to local or certain kinds of causes. Some may be more specific than others on the minimum size and/or maximum frequency of your grant requests. Some have simplified the grant-making process through online automation; others have not.

Investment Policies – DAF assets are typically invested in the market, so they can grow tax-free over time. But some investments are far more advisable than others for building long-term giving power! How much say will you have on investment selections? If you’re already working with a wealth advisor, it can make good sense to choose a DAF that lets your advisor manage these account assets in a prudent, fiduciary manner. PLC Wealth employs an evidence-based investment strategy for all our managed assets.

Transfer and Liquidation Policies – What happens to your DAF account when you die? Some sponsors allow you to name successors if you’d like to continue the account in perpetuity. Some allow you to name charitable organizations as beneficiaries. Some have a formula for distributing assets to past grant recipients. Some will roll the assets into their own endowment. (Most will at least do this as a last resort if there are no successors or past grant recipients.) Also, what if you decide you’d like to transfer your DAF to a different sponsoring organization during your lifetime? Find out if the organization you have in mind permits it.

Deciding on Your Definitive DAF

Selecting an ideal DAF sponsor for your tax planning and charitable intent usually involves a process of elimination. To narrow the field, decide which DAF features matter the most to you, and which ones may be deal breakers.

If you’re working with a wealth advisor such as PLC Wealth Management, we hope you’ll lean on us to help you make a final selection, and meld it into your greater personal and financial goals. As Wharton Professor and “Give and Take” author Adam Grant has observed, “The most meaningful way to succeed is to help others succeed.” That’s one reason we’re here: to help you successfully incorporate the things that last – like generosity – into your lifestyle.

Tune out the noise…

This short video from our friends at Dimensional Fund Advisors is worth a couple minutes of your time…view Tuning Out the Noise here. It highlights one of the ways that we, as advisers, aspire to bring value to our clients lives. It is also a friendly reminder to focus on what matters, and ignore the rest.