Your Money Trailguide helping you pursue your great adventure now.

Continue readingQ4 Letter to Clients

Quarterly update to clients

Continue readingTD-Schwab Merger Update

Latest details on the TD-Schwab merger.

Continue readingIs the Debt Ceiling Bringing You Down?

Fee Reductions

Happy New Year! I hope this message finds you well after enjoying the holidays. I just have a quick note to share to start off our new year. A longer post will be coming later this week as our quarterly letter to clients.

2020 was a tough year on many fronts, but one thing it taught us is that market performance in the short term is wildly unpredictable. In addition, short-term performance will likely have a small impact, if any, on your probability of success with your own financial goals. So it is really not worth your mental energy to ever spend a moment worrying about your short term investment performance. Plus, none of us really have any control over investment performance.

What do we have control over? From a planning and investment standpoint, we discuss fees quite often, and look to reduce this financial headwind where possible because this is something we can control. Most of our clients have Dimensional Funds as core holdings in their portfolio, so we were happy to hear this fall that they announced that fees would be reduced across a broad range of their equity funds effective February 2021, representing an approximate 15% reduction on an asset-weighted basis. They were already significantly lower than the average mutual fund expense ratio, so this is a great move in the right direction. It is exciting because it means that, all else equal, our clients will get to keep more of the investment’s returns which will have a compounding effect on wealth over the years.

Reducing fees is only one way to increase your wealth over time. Let us know if you would like to discuss the other planning tools that can be used to increase wealth as well.

Watch out for scams!

Most North Carolinian’s are working hard to take care of their families and help their neighbors in the current crisis. Nevertheless, criminals seek to exploit the Covid-19 pandemic to further their scams.

We received the notice below from the North Carolina Secretary of State warning residents to be wary, and we want to share it with you. If you or someone you care about comes across something questionable related to investing or charitable activities, please don’t hesitate to call. We can help you check it out. PLC Wealth is here to help you and answer any questions you have.

Take care, and thank you for your business with PLC Wealth.”

======================================================================================================================================

NC Secretary of State Offers Tips to Avoid COVID-19 Related Investment Scams

NC Secretary of State Elaine Marshall is cautioning investors that the ongoing Coronavirus pandemic will likely spark a surge of investment fraud.

“Sadly, scam artists will seek to exploit rising concerns about COVID-19 to draw people into investment traps,” warned Marshall. “Fraudsters often use the day’s headlines in their pitches, so expect to see them prey on the fear surrounding the unfolding Coronavirus pandemic and recent economic developments to promote sham investments.”

The North American Securities Administrators Association (NASAA), of which the NC Secretary of State’s Office is a member, is joining state regulators in offering tips to keep investors safe in these uncertain times.

Bad actors may develop schemes falsely purporting to raise capital for companies manufacturing surgical masks and gowns, producing ventilators, distributing small-molecule drugs and other preventative pharmaceuticals, or manufacturing vaccines and miracle cures.

Scammers also will seek to take advantage of concerns with the volatility in the securities markets to promote “safe” investments with “guaranteed returns” including investments tied to gold, silver and other commodities; oil and gas; and real estate. Investors also can expect to see schemes touting quickly earned guaranteed returns targeting seniors worried about economic disruptions and losses to their retirement portfolios.

“From guarantees of high returns without risk to promises of a miracle cures, if it sounds too good to be true, it probably is,” warned Secretary Marshall. “I urge North Carolinians to follow these tips to help protect your financial and physical health as you navigate these uncertain times.”

Investors are encouraged to call the NC Investor Hotline at (800) 688-4507 or email us at before signing over money in any investment opportunity. If you suspect an investment opportunity is fraudulent, you may report it at www.sosnc.gov. You can also find a wealth of investor education material at www.sosnc.gov/divisions/securities.

Schemes to Watch for:

Private placements and off-market securities. Scammers will take advantage of concerns with the regulated securities market to promote off-market private deals. These schemes pose a threat to retail investors because private securities transactions are not subject to review by federal or state regulators. Retail investors must continue to investigate before they invest in private offerings and independently verify the facts for themselves.

Gold, silver and other commodities. Scammers may also take advantage of the decline in the public securities markets by selling fraudulent investments in gold, silver and other commodities not tied to the stock market. These assets are often promoted as “safe” or “guaranteed” means of hedging against inflation and mitigating systematic risks. However, scammers may conceal hidden fees and mark-ups, and the illiquidity of the assets that may prevent retail investors from selling the assets for fair market value. There are no “can’t miss” opportunities.

Recovery schemes. Retail investors should be wary of buy-low sell-high recovery schemes. For example, scammers will begin promoting investments tied to oil and gas, encouraging investors to purchase working or direct interests now so they can recognize significant gains after the price of oil recovers. Scammers will also begin selling equity at a discount, promising the value of the investments will significantly increase when the markets strengthen. Never lose sight of the risks associated with any prediction of future performance and remember that market gains may not correlate with the profitability of their investments.

Get-rich-quick schemes. Scammers will capitalize on the increased unemployment rate with false promises of quick guaranteed returns that can be used to pay for rent, utilities or other living expenses.

Replacement and swap schemes. Investors should be wary of any unlicensed person encouraging them to liquidate their investments and use the proceeds to invest in more stable, more profitable products. Investors may pay considerable fees when liquidating investments, and the new products often fail to provide the promised stability or profitability. Advisors may need to be registered before promoting these transactions and legally required to disclose hidden fees, mark-ups and other costs.

Real estate schemes. Real estate investments may be appealing because the real estate market has been strong and low interest rates have increased demand. Scammers often promote these schemes as safe and secure, claiming real estate can be sold and the proceeds can be used to cover any losses. However, real estate investments present significant risks, and changes to the economy and the real estate market may negatively impact the performance of these products.

How to Protect Yourself:

The NC Secretary of State’s Securities Division offers this guidance to help investors avoid investment scams:

Ask before you invest. Investors in North Carolina should call the NC Investor Hotline at (800) 688-4507 or email us at to find out if the salesperson and the investment opportunity itself are properly registered. Investors also can check the SEC’s Investment Adviser Public Disclosure database and FINRA’s BrokerCheck. Avoid doing business with anyone who is not properly licensed. If you suspect fraud, please report it to us at www.sosnc.gov.

Don’t get hooked by a phishing scam. Phishing scams may be perpetrated by those claiming an association with the Centers for Disease Control and Prevention, the World Health Organization, or by individuals claiming to offer medical advice or services. Watch out for con artists offering “opportunities” in research and development. These scams may even be perpetrated by people impersonating government personnel, spoofing their email addresses and encouraging victims to click links or open malicious attachments. These emails may look real and sound good, but any unsolicited emails with attachments and web links may be directing you to dangerous websites and malicious attachments that can steal information from your computer, lock it up for ransom, or steal your identity. When in doubt, don’t click.

There are no miracle cures. Scientists and medical professionals have yet to discover a medical breakthrough or develop a vaccine or cure for COVID-19. Don’t fall for online pharmacies claiming to offer vaccines and don’t send money to anyone claiming they can prevent COVID-19, through a vaccine or other preventive medicine.

Avoid fraudulent charity schemes. White-collar criminals may pose as charities soliciting money for those affected by COVID-19. Fake charities will frequently use sound alike names that mimic established charities. Rather than clicking on the links or responding to the email addresses or phone numbers provided in a text, email or social media post, do an internet search to find the charity’s website and reach out to them directly. A link in an unsolicited email could send you to an impostor site. Give generously but wisely to make sure your help is going to those who need it.

Be wary of schemes tied to government assistance or economic relief. The federal government may send checks to the public as part of an economic stimulus effort. It will not, however, require the prepayment of fees, taxes on the income, the advance payment of a processing fee or any other type of charge. Anyone who demands prepayment will almost certainly steal your money. And don’t give out or verify any personal information. Government officials already have your information. No federal or state government agency will call you and ask for personal

A Covid-19 update from your PLC Wealth team

To say the last couple of weeks have been unexpected, unparalleled and dizzying would still be understating exactly what we have lived through in the last few weeks. Based on further news today (specifically, the Stay at Home Orders issued by Wake County, NC for our local clients), most of us will be sheltering in place for the coming weeks, as we should. I have listened intently, as I am sure you have, to all sides of the discussion that has carried on since the beginning of the outbreak. At this point, the experts are making the case for the seriousness of the virus as it spreads exponentially, and that it is likely that the healthy and optimistic among us could be putting our most vulnerable at risk. Slowing down our movement even further, whether by choice or by requirement, seems to be inevitable for a while longer to give us all the best opportunity to get through this. While we do not know how long this Covid-19 virus will last, I want to take a few moments to speak to you directly about what we are doing as a firm and how you can continue to reach us during these times.

We have implemented many changes in the last couple of weeks as part of our Business Continuity Plan due to Covid-19. Thankfully, we were prepared for a remote working environment, and hopefully you have seen no interruption in the normal service from our team. We have all set up our home workspace. This give us access to our email, phone calls, and client files just as easily as we have them in the office. Our phone service is fully digital which means we can take it with us wherever we go. If you call the office and dial my extension, it will ring my mobile phone. If I call you from my mobile phone, I will be doing so from my office line. We also have a fully digital and secure document management system for our firm which means we can safely access all your files at any time of day from any location in the world. Additionally, all our portfolio management, financial planning and client relationship software is cloud-based and accessible from any location. Believe it or not, it really did not take much time for PLC Wealth to convert to a virtual firm with the same capabilities as when physically in the office.

Now, obviously, there are some challenges. It is impossible to fully replace the face-to-face relationship, both for our internal operations and for our client relationships. We are utilizing a secure and compliant messaging tool for internal communications. While there may be times that we need to access the office, we are attempting to have only a 1-person max in the office at any time. We will also plan to continue with client meetings moving forward through virtual meeting technologies such as Zoom. If you do not have access to a computer for such a meeting, we can still have a conversation the old school way…over the phone…in order to make sure that we do not fall behind in our relationship with each of you. Again, if you need us in the meantime, we are an email or phone call away, just as we have always been.

There are a few logistical items to cover: First, mail will be checked regularly, but maybe not every day. Additionally, we have always made the effort to suggest linking your personal bank account to your brokerage accounts to allow for quick money movements back and forth, should they be necessary. Since we are no longer at the office, a time like this makes it necessary. So, if you need to make an IRA contribution or want to add funds to your brokerage account, we can still do that by an electronic transfer. Getting money from your accounts is just as easy, or we can have a check mailed to you. The bottom line is that getting money from your accounts or to your accounts is just as easy as always. Finally, if you have actual stock certificates, those must be mailed directly to TD for deposit in your account, so just let us know if you need the mailing address.

Unfortunately, times of crisis create opportunities for bad actors. There are already stories of scams coming to the surface, so be prepared and know what to look for:

- – There are no miracle drugs or remedies for Covid-19 at this time so don’t fall for this one. And do not click on any links that may be in an email stating such things, as the link may be another way to inject a virus on your computer.

- – Be very skeptical of any investment ‘opportunities’ with research claims that are no supportable. People will make wild claims to prey on other’s hopes and inability to use the rational brain in times of stress.

- – Never, never, never disclose your social security number, account numbers, or any other piece of Personally Identifiable Information (PII). There are rumors that spam calls and emails are already going out claiming that thsi information is needed to get your piece of the Stimulus bill or a tax refund. Hold on to your PII like you (financial) life depends on it.

- – Generally, just be skeptical in these times of anything that seems too good to be true. If you are not sure, get in touch with us to talk through it.

Let me leave you with a little encouragement in the midst of Covid-19 . Take this time to do something that many of us no longer do naturally on our own…slow down, exercise (by yourself), rest, re-energize, call someone you haven’t spoken with in a while, or binge watch movies with your family that you never have the time for…but mostly, just look around you to see all of the blessings that you inevitably still enjoy. Sometimes, when we are not able or willing to do that which is in our best interest, it is necessary for it to be forced upon us. We find ourselves in one of those times in history. We are a creative and adaptive species so I look forward to hearing about some of the ways that you will get through this…because you will get through this. I will leave you with three pieces of advice that I am confident will be good for you in the long run…Wash your hands, don’t touch your face, and don’t touch your stocks. Know that we are committed to continuing to serve you and your family. We will strive to provide you with an even higher level of service than that which you have come to expect from us. If you need anything at all, even if it is just to have a conversation about the events of the day, please let us know. We are here to help.

Carpe diem,

Josh and the PLC Wealth Team

Volatile equity markets, falling bond yields, and the coming recession: A letter to our clients

By Matt Miner

August 15, 2019

Dear Clients,

First, THANK YOU for your business with PLC Wealth Management! We are honored to serve as your advisors and to walk through life with you.

Second, we think today is a good day to talk with you about jumpy stock markets, falling bond yields, and our thoughts regarding the US economy. Our letter wraps up with actionable advice for you to implement immediately. Pretty exciting, right?

As I prepared to join my family for dinner last evening, I received a forwarded email. According to a tweet by advisor Michael Batnick, yesterday was the 307th time that the Dow fell 3% or more in a single day, over the course of the last 100 years. To see the folks on CNBC jumping up and down, wild eyed and foaming at the mouth, you could be forgiven for imagining that the entire US economy been vaporized.

Volatile Stock Markets

On average a downward move of the magnitude we experienced yesterday happens 3.07 times each year. Equity markets have been mostly placid over the last decade, and yesterday’s market decline was the first drop of that size in 2019. But if we simply achieve historically average volatility, we can expect two more moves of the same size before we celebrate New Year’s Day 2020! Said differently, drops of 3% come around slightly more than three times as often as Christmas.

For a different comparison, UNC and Duke always get invited to the NCAA Men’s Basketball Tournament. In each program’s history, UNC has played 160 NCAA tournament games and Duke has played 147 NCAA tournament games. Coincidentally, the Dow Jones Industrial Average has declined 3% or more in a single day in the last 100 years the same number of times as the two most storied programs in college basketball have played a game in the NCAA tournament: Many, many, times! Stock market volatility is table steaks. It’s why investors expect to earn a positive return for investing in stocks.

The Russell 3000, one of our preferred index comparisons, was down 2.89% yesterday and is down 4.85% for the month. No one likes that. But the same index is up 14.63% in 2019, 9.53% per year on a rolling five-year basis, and 13.20% per year on a rolling ten-year basis (ftserussell.com as of 8/14/2019 market close).

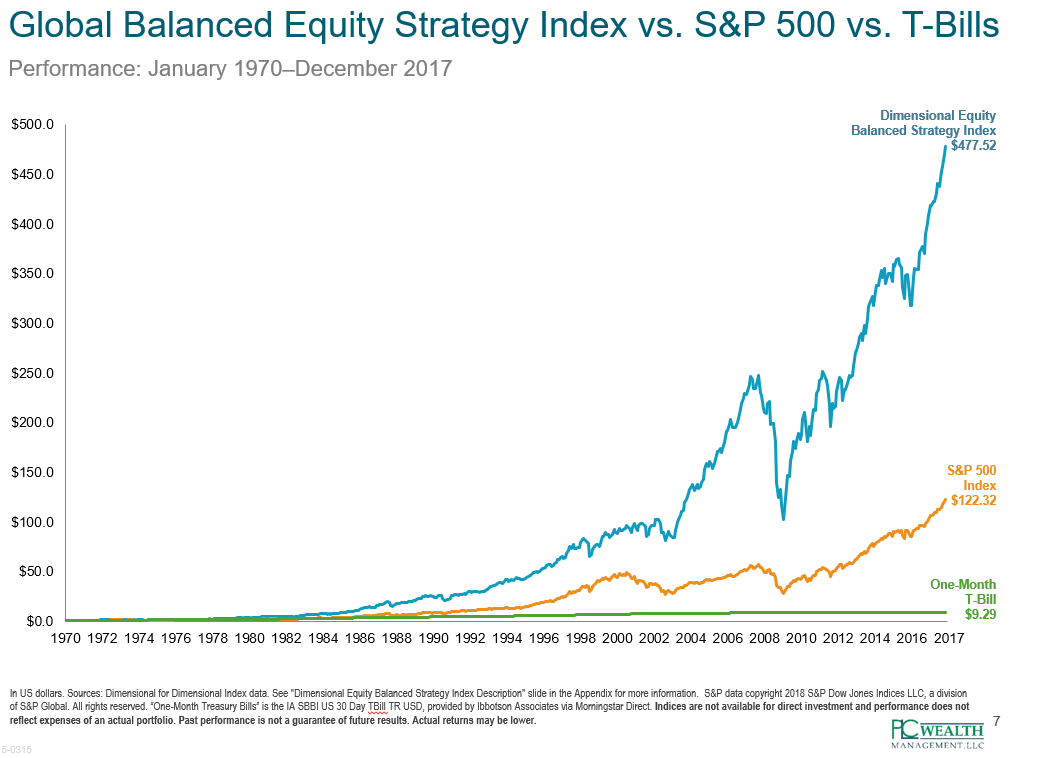

The stock market can be a rough ride, but it has reliably propelled investors’ wealth upward over time. The chart below shows the growth of one dollar from 1970 to 2017 invested in one-month T-Bills, the S&P 500 Index, and in a globally diversified stock portfolio, similar to PLC Wealth’s equity investment style.

Friends and neighbors, you only get hurt on a roller coaster if you jump off.

Falling Bond Yields

It is true that bond yields have fallen, meaning that money invested in the bond market today earns less interest than it did at this time last year. This has resulted in strong appreciation of bond funds (bond prices move in an inverse relationship to bond yields). For example, DFAPX, an investment-grade bond fund, has appreciated 7.81% in 2019, something I did not expect as we entered this year. On the other hand, falling rates mean that maturing bonds will be reinvested at lower interest rates than bonds that matured in the recent past. It also means that interest rates earned on assets like money market funds, certificates of deposit, annuities, and savings accounts have been reduced.

The Yield Curve

What about the ever-famous inverted yield curve? Once you finish this article you’ll be able to amaze your friends and confound your enemies because you’ll know the answers to questions like, “What is a yield curve?” and “What is an inverted yield curve?” and “What does a yield curve inversion mean?” and most meaningfully, “What should I do?”

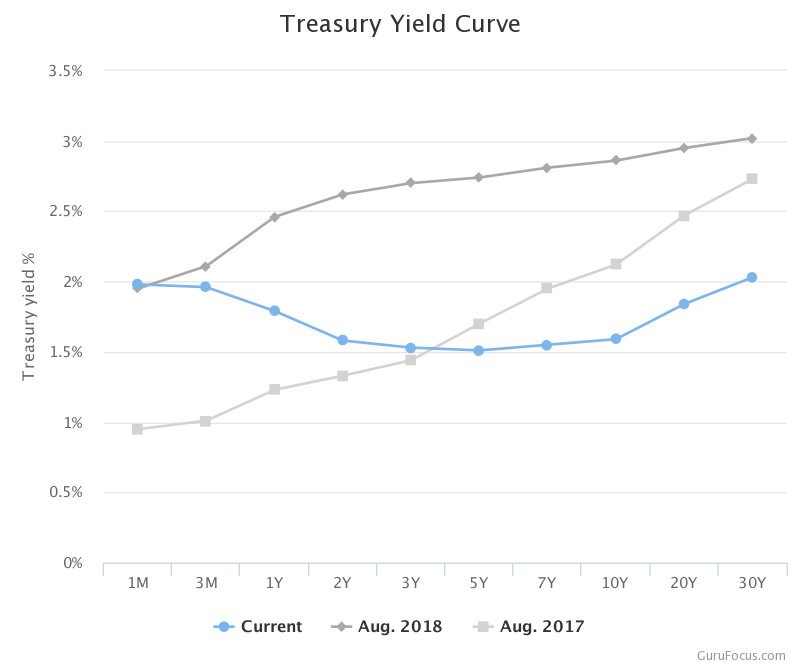

First, a yield curve plots the returns investors expect on debt over different periods of time – for example one, five, ten, and thirty years. Investors normally demand to be paid more to loan their money for longer periods. You may have experienced this as a consumer: 30-year mortgage rates are higher than 15-year mortgage rates. This is because the longer the loan, the greater the investor’s exposure to the vagaries of inflation, the risk that the borrower fails to repay, and the risk that the money is locked up at a time the investor wants liquidity. In the graphic below, the August 2018 yield curve (the line with the gray diamonds) is the most “normal” looking, even though the rates are low by historic standards.

Second, an inverted yield curve like the blue line with dots, labeled “Current” in the graph above, means that investors demand 2% to loan to the US government for one year, but only ~1.65% to loan for ten years. How can this be? The inverted yield curve signals that bond investors expect poor economic performance resulting in low interest rates over that time period.

Third, an inverted yield curve has accurately predicted economic recession (two or more quarters of negative growth) or an economic slowdown (a reduction in the growth rate) with 100% accuracy going back to the Eisenhower administration. The predictive value of the inverted yield curve is particularly potent if the inversion lasts for more than one full quarter which is the case as I write you this letter.

Here’s the unvarnished truth: A recession is coming. A recession is always coming. What we don’t attempt to do is predict when the recession will arrive. The fact that a recession is coming is part of your plan. When you work with an advisory firm like PLC Wealth, your plan includes the expectation of recession. It’s kind of like knowing you’ll need to replace your car. You don’t know exactly when you’ll need a new car, but you’ll need one sometime. By planning with PLC Wealth, you have prepared for recession.

Cam Harvey, a terrific professor at my business school alma mater – Duke’s Fuqua School of Business – was quoted yesterday by WRAL saying, “Maybe this is not the right time to max out your credit card…Maybe it’s not the right time to take the vacation with your family that is going to overextend you.” Professor Harvey goes on to recommend you “[do] 100% effort at your job.”

At PLC Wealth we never recommend you max out your credit card. Instead, we recommend you negotiate discounts and pay cash!

We love vacations, but we don’t recommend you overextend yourself to take one. Go camping if that is what your budget supports!

Putting in 100% effort at work is timeless advice your dad gave you, too.

Call to Action

What should you do to prepare for the coming recession? For that matter, what should you do to prepare for the coming prosperity? The advice does not change. Do excellent work. Live on less than you make. Invest the difference wisely. Make a good tax plan. Bless your family with a thoughtful estate plan. Prepare for catastrophe with suitable insurance and emergency funds. Care for your health. Spend time with the people you love. Live according to your values. Be kind.

If you have questions about market volatility, bond yields, or the coming recession, give us a call. We are here to help with any topic where life meets money. Once again, thank you for your business with PLC Wealth Management.

Home is where the __________ is. 1.) Heart or 2.) Hassle?

June 17, 2019

Matt Miner

Over the weekend I received a thoughtful note from a client about renting versus owning.

Our client asked what we thought about the possibility of renting throughout one’s entire life, and taking the money that would be used for a large house down payment (in this case, a 100% down payment) and investing it as we recommend. I wanted to share my reply below:

Dear N_________,

It’s always great to hear from you!

First, there’s nothing wrong with renting for the rest of your life as long as this is part of your plan, and you do it eyes-wide open. Like anything, it is just a whole lot better if it’s intentional. This is how you’re approaching it, so well done!

In your mail you mention that owning a home means you have to pay taxes on it and maintain it for the rest of your life. This is true, but renting just means you pay someone else to do this for you.

You are correct that you could probably invest the money you’re putting into this house and get enough return to continue renting throughout your life. We can model this with some assumptions if you’d like.

Whether renting forever is scary just depends on your planning. We can share with you that according to Tom Stanley, (author of The Millionaire Next Door and other data-driven books about the wealthy), 95 – 97% of wealthy people choose to own their own home with these type of ratios:

1.) 10% – 25% of their net worth tied up in the house

2.) A mortgage balance between Zero-times and Three-times annual income (not more)

For a family earning $120,000 per year, with a net worth of $350,000 that WANTED to own, these could be reasonable numbers:

- $360,000 purchase price

- $72,000 down (< 25% of total net-worth tied up in the house)

- $288,000 mortgage balance (< 3X annual income)

- All-in monthly / annual payment of $2300 / $27,600

The family in this case should have enough money to build wealth. Even though the bank may be happy to approve their application (!) a $500,000 house is too expensive for this family. As our friend Tom Stanley says, asking the bank how much you should borrow is like asking a fox to count the chickens in your henhouse. On the other hand, a $275,000 house will allow them to become wealthier faster, or to support other goals along the way, such as travel, children’s education, or giving.

For a family in retirement with a net worth of $1.7M, having a paid-for $360,000 house would be totally reasonable; this is less than 25% of their total net worth. For this retired family, a $700,000 house is too much. The home will make it difficult for their other assets to support their lifestyle.

On the positive side, when you own a home, what you get is some protection from long-term inflation for part of your housing budget, and you get a portion of your portfolio returning a very predictable amount once you own it in cash: You save the principal and interest portion of your mortgage payment.

As you can see from the ratios above, we don’t recommend putting 100% or even 50% of your net worth into a house. On the other hand, copying what wealthy people do in terms of habits and ratios is usually a good idea too!

Conceptually, when you rent, this is what you pay:

Rental Price

- Landlord’s Cost of Capital on the home itself

- PLUS Landlord’s Profit

- PLUS Landlord’s Real Estate Taxes & Insurance

- PLUS Landlord’s Maintenance and Repair Costs

- MINUS Tax Benefits that may accrue to the Landlord (deductibility of repair expense, interest expense & depreciation, possibly at a higher tax rate than your own)

When you own, this is what you pay:

Home Ownership Price

- Your cost of capital on the home itself

- PLUS Your Real Estate Taxes & Insurance

- PLUS Your Maintenance and Repair Costs

- MINUS Tax Benefits that may accrue to you (for middle-income tax payers, the TCJA has made this less likely given a much higher standard deduction)

Just looking at that formula lets you know that for an equivalent house, all else equal, by owning you will save the Landlord’s Profit component MINUS any tax benefits that may be greater for the Landlord than they are for you (you may or may not be able to deduct your interest and real estate taxes each year, and you cannot deduct repairs or depreciation as an owner-occupant).

Rather than reinvent the wheel with a bunch of calculations, please check out this excellent article, and then let me know if you want to go deeper on any of this. In a lot of ways, it all comes down to preference and then putting the right plan in place for you.

https://affordanything.com/is-renting-better-than-buying-should-i-rent-or-buy/

We wish you all the best!

Matt

Fuqua Finance Forum – April 10th, 2019

Photos (left) Laurinda & Matt and (right) Ruben, Oriana, Matt, Laurinda, Monique, & Francisco

Matt Miner

April 10th, 2019

Whoa! Sitting over here at WaDuke thinking about the excellent conversation we had together this morning. Such a delight to be with y’all, with Laurinda, and with Professor Dyreng. Huge thanks to BLMBAO for this opportunity.

Thanks to all the folks who wanted to chat afterward. I am honored that our time together was helpful to you.

Thanks to the several of you who asked about copies of the slides. They are posted below for you to review, anytime.

Wishing you every success with life and money,

Matt Miner

Some additional reference material below:

Recent interview on Radical Personal Finance podcast about my career transition to planning.

Interview on Masters of Money podcast

Blogs posts I referenced yesterday:

Renting versus owning – Afford Anything

The Shockingly Simple Math – Mr Money Mustache

Book recommendations:

Millionaire Next Door by Stanley is always top of the heap. The idea is that wealth is about habits.

Total Money Makeover by Ramsey is the best motivation book (“why”) and the best budgeting book

The Only Investment Guide You’ll Ever Need by Chris Tobias is terrific on both PF and investing topics

Personal Finance for Dummies by Tyson is comprehensive and accessible.

If you Can by Bernstein is a great DIY resource.

Your Money or your Life, by Dominguez and Robbins, is the frugality book. Frugality: you can control your spending and achieve a high savings rate on any income.

The Automatic Millionaire by Bach

Richest Man in Babylon by Clason – seminal in this genre

The Wealthy Barber by Chilton – story based and easy PF content