Scan the financial headlines these days, and you’ll see plenty of potential action items vying for your year-end attention. Some may be particular to 2023. Others are timeless traditions. If your wealth were a garden, which actions would actually deserve your attention? Here are our four favorite items worth tending to as 2024 approaches … plus a thoughtful reflection on how to make the most of the remaining year.

1. Feed Your Cash Reserves

With basic savings accounts currently offering 5%+ annual interest rates, your fallow cash is finally able to earn a nice little bit while it sits. Sweet! Two thoughts here:

Mind Where You’ve Stashed Your Cash: If your spending money is still sitting in low- or no-interest accounts, consider taking advantage of the attractive rates available in basic money market accounts, or similar savings vehicles such as short-term CDs, or U.S. Series I Saving Bonds (“I Bonds”). Your cash savings typically includes money you intend to spend within the next year or so, as well as your emergency, “rainy day” reserves. (Note: I Bonds require you to hold them for at least a year.)

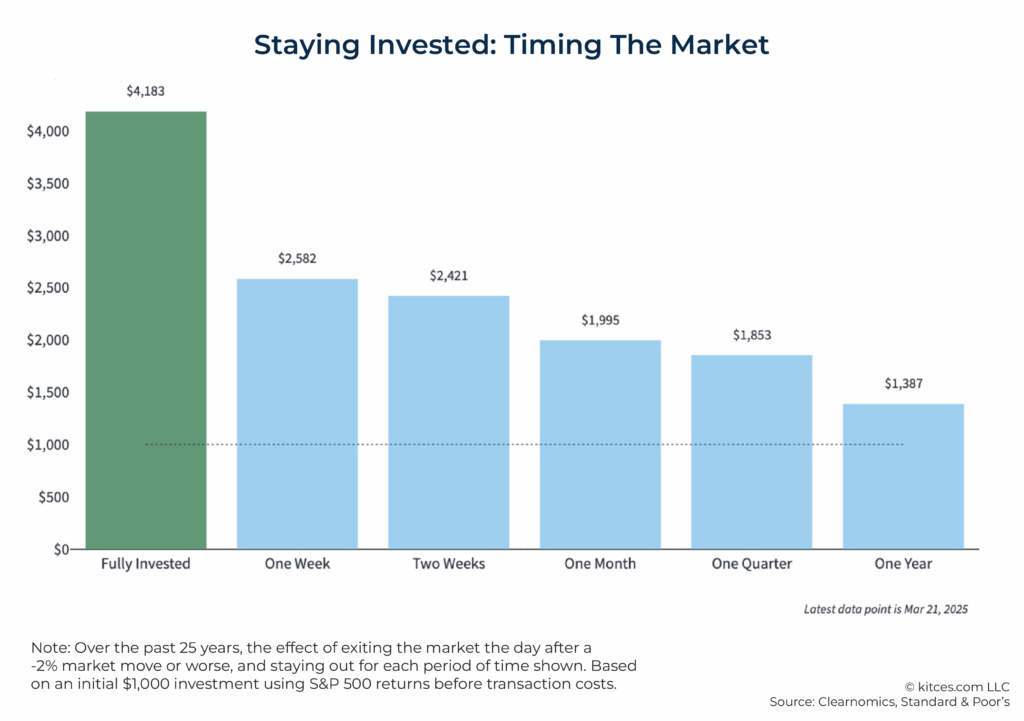

Put Your Cash in Context: While current rates across many savings accounts are appealing, don’t let this distract you from your greater investment goals. Even at today’s higher rates, your cash reserves are eventually expected to lose their spending power in the face of inflation. Today’s rates don’t eliminate this issue … remember, inflation is also on the high side, so that 5% isn’t as amazing as it may seem. Once you’ve got your cash stashed in those high-interest savings accounts, we believe you’re better off allocating your remaining assets into your investment portfolio—and leaving the dollars there for pursuing your long game.

2. Prune Your Portfolio

While we don’t advocate using your investment reserves to chase money market rates, there are still plenty of other actions you can take to maintain a tidy portfolio mix. For this, it’s prudent to perform an annual review of how your proverbial garden is growing. Year-end is as good a milestone as any for this activity. For example, you can:

Rebalance: In 2023, relatively strong year-to-date stock returns may warrant rebalancing back to plan, especially if you can do so within your tax-sheltered accounts.

Relocate: With your annual earnings coming into focus, you may wish to shift some of your investments from taxable to tax-sheltered accounts, such as traditional or Roth IRAs, HSAs, and 529 College Savings Plans. For many of these, you have until next April 15, 2024 to make your 2023 contributions. But you don’t have to wait if the assets are available today, and it otherwise makes tax-wise sense.

Revise: As you rebalance, relocate, or add new holdings according to plan, you may also be able to take advantage of the latest science-based ETF solutions. We’re not necessarily suggesting major overhauls, especially where embedded taxable gains may negate the benefits of a new offering. But as you’re reallocating or adding new assets anyway, it’s worth noting there may be new, potentially improved resources available.

Redirect: Year-end can also be a great time to redirect excess wealth toward personal or charitable giving. Whether directly or through a Donor Advised Fund, you can donate highly appreciated investments out of your taxable accounts and into worthy causes. You stand to reduce current and future taxes, and your recipients get to put the assets to work right away. This can be a slam dunk strategy to avoid an embedded capital gain and get a tax deduction for the full value going to the charity of your choice. If you have appreciated assets, considering gifting these and holding on to your cash.

3. Train Those Taxes

Speaking of taxes, there are always plenty of ways to manage your current and lifetime tax burdens—especially as your financial numbers and various tax-related deadlines come into focus toward year-end. For example:

RMDs and QCDs: Retirees and IRA inheritors should continue making any obligatory Required Minimum Distributions (RMDs) out of their IRAs and similar tax-sheltered accounts. With the 2022 Secure Act 2.0, the penalty for missing an RMD will no longer exceed 25% of any underpayment, rather than the former 50%. But even 25% is a painful penalty if you miss the December 31 deadline. If you’re charitably inclined, you may prefer to make a year-end Qualified Charitable Distribution (QCD), to offset or potentially eliminate your RMD burden.

Harvesting Losses … and Gains: Depending on market conditions and your own portfolio, there may still be opportunities to perform some tax-loss harvesting in 2023, to offset current or future taxable gains from your account. As long as long-term capital gains rates remain in the relatively low range of 0%–20%, tax-gain harvesting might be of interest as well. Work with your tax-planning team to determine what makes sense for you.

Keeping an Eye on the 2025 Sunset: Nobody can predict what the future holds. But if Congress does not act, a number of tax-friendly 2017 Tax Cuts and Jobs Act provisions are set to sunset on December 31, 2025. If they do, we might experience higher ordinary income and capital gains tax rates after that. Let’s be clear: A lot could change before then, so we’re not necessarily suggesting you shape all your plans around this one potential future. However, if it’s in your overall best interests to engage in various taxable transactions anyway, 2023 may be a relatively tax-friendly year in which to complete them. Examples include doing a Roth conversion, harvesting long-term capital gains, taking extra retirement plan withdrawals, exercising taxable stock options, gifting to loved ones, and more.

4. Weed Out Your To-Do List

I love this one…it is at the top of my improvement goals. Doing less instead of staying busy with more. This year, we’re intentionally keeping our list of year-end financial best practices on the short side. Not for lack of ideas, mind you; there are plenty more we could cover.

But consider these words of wisdom from Atomic Habits author James Clear:

“Instead of asking yourself, ‘What should I do first?’ Try asking, ‘What should I neglect first?’ Trim, edit, cull. Make space for better performance.”

— JamesClear.com

Let’s combine Clear’s tip with sentiments from a Farnam Street piece, “How to Think Better.” Here, a Stanford University study has suggested that multitasking may not only make it harder for us to do our best thinking, it may impair our efforts.

“The best way to improve your ability to think is to spend large chunks of time thinking. … Good decision-makers understand a simple truth: you can’t make good decisions without good thinking, and good thinking requires time.”

— Farnam Street

In short, how do you really want to spend the rest of your year? Instead of trying to tackle everything at once, why not pick your favorite, most applicable best practice out of our short list of favorites? Take the time to think it through. Maybe save the rest for some other time.